Cancer Infographic

How expensive is it to be in the 60%?

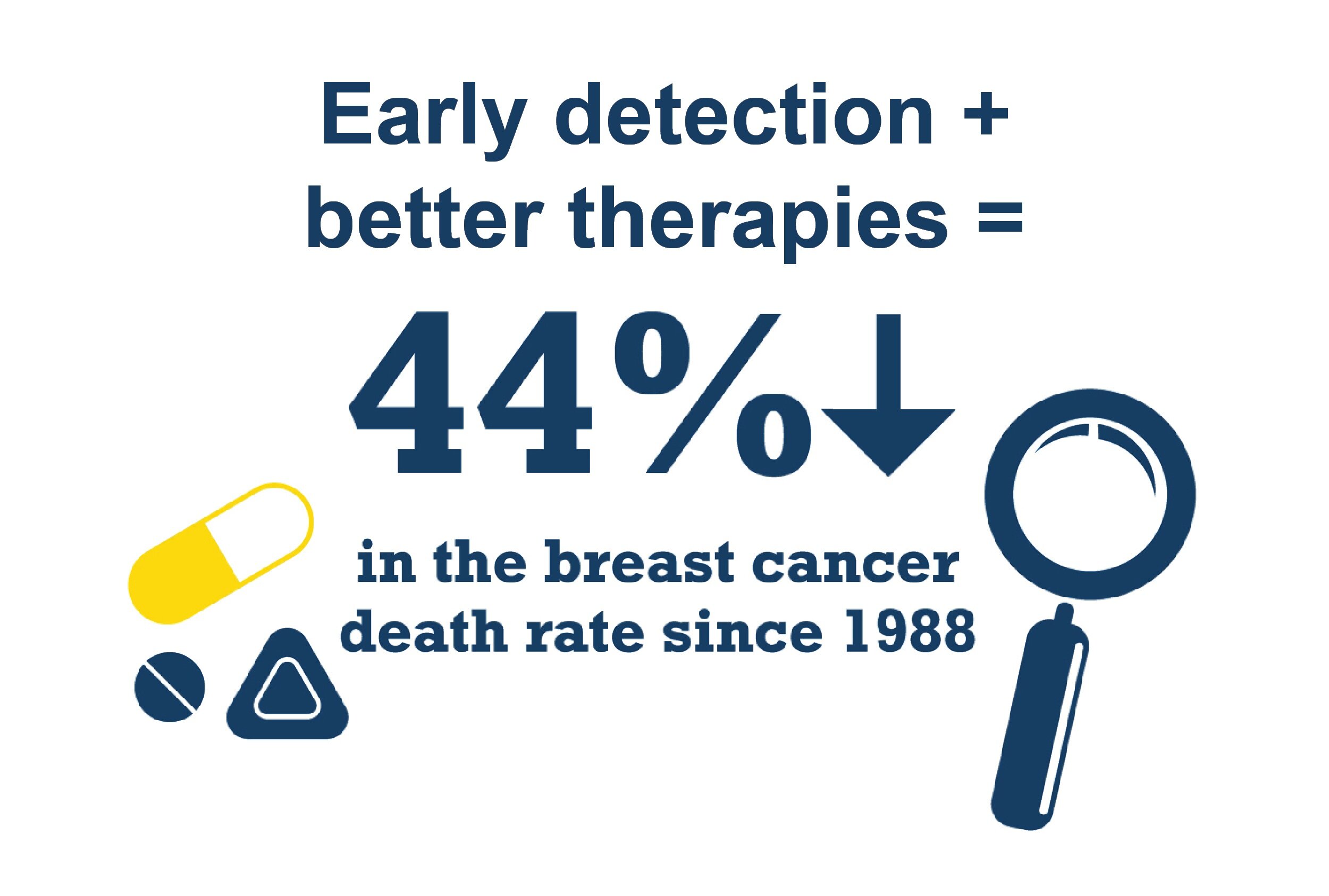

Cancer research has made it possible for more people to survive a cancer diagnosis. Although survival rates are rising, unfortunately so too is the likelihood of getting cancer. In fact, there are almost 90,000 new cancer cases among working age Canadians every year. With better outcomes and younger survivors, there is an increased need for employee benefit programs that include living benefits like Critical Illness insurance.1 A critical illness may require time off from work (especially if it is a cancer diagnosis), which can make it difficult to manage existing household expenses, not to mention the unforeseen costs of getting sick.

Here's a look at the type of costs that can add up when a person is diagnosed with cancer:

Treatment and prescription drugs (not all drugs are covered by the government)

Personal care and support workers

Hospitalization in a semi private room

Transportation to and from each medical appointment, i.e. gas, taxi or car rental

Hospital parking for each appointment or for visits from friends and family

Child care during weekly appointments

As a result, the tax-free lump sum benefit provided by a Critical Illness policy can be an integral part of an employee's road to recovery and add significant value to an employer's benefit plan.

To learn more about the benefits of Critical Illness coverage, please contact Chris Carr at 416.307.5622.

1 Bonnett, C. and Smofsky, A. (2018). Best practices in managing cancer: A practical approach for employers.